Hold the Line for Now

This year is looking like it's going to be very long. As I'll explain later, Janet Yellen really pumped this market last year, and the air is coming out. It will take a long time to take it lower.

Action to take: A squeeze appears to be under way, so we’ll start exiting any additional positions as we wait for the Fed to take us higher. The big problem right now is that so much stimulus has left the market, and despite the correction, insiders have largely remained on the sidelines.

-------------------

Dear Fellow Insider,

This market wants to run.

After two weeks of relentless selling, we're finally getting some classic Fed-drift action as investors position ahead of next week's Federal Reserve meeting.

The S&P 500 has bounced off oversold levels and seems ready to move higher, at least in the short term.

We're not betting the farm here, but you should know we might see a quick run higher—just don't get too comfortable yet.

Our broader momentum signal is still negative, but pockets of insider buying are emerging, signaling cautious optimism in certain sectors.

Energy is one area where insiders are starting to nibble again, though our ratio has only slightly increased so far.

With executives still cautious and insider buying far below the enthusiastic levels we typically see at market bottoms, we're not yet rushing back into the market.

Insider buying often precedes sustained market moves, and while we’re seeing some accumulation returning after weeks of near-total absence, it isn't the broad-based buying spree that would signal an all-clear.

It’s not here yet.

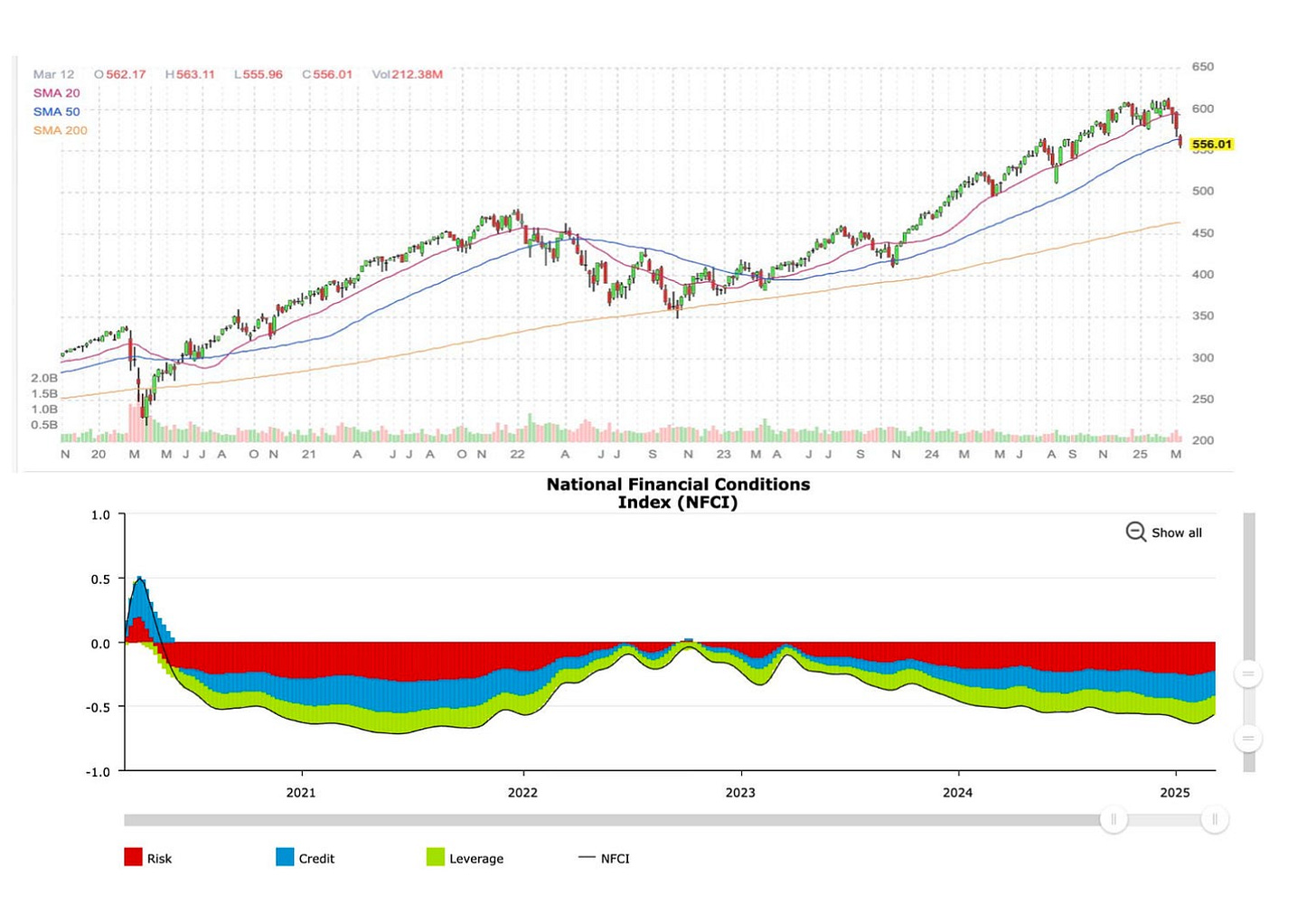

We're tracking the chart above daily, watching closely for insiders to show stronger conviction and confirm a meaningful turn.

Macro Issues

Money is running out of America. And a debt-bubble - fueled by the Treasury Department last year - is popping. It took me a little longer than usual to see this, but it’s become apparent that the Treasury and Fed did something last year that eluded a lot of people (and still does). There’s no sugar high - and we’re in a similar situation to the back end of 2021.

We have a situation where we haven’t seen any significantly good news.

Markets, however, will cry for good news when there is significant selling. On Thursday, we hit selling pressure (and a lack of buying pressure) that we haven’t seen since the GILT Crisis and the start of Quantitative Easing.

Unfortunately, the worst isn’t over. So much liquidity is leaving the system that it feels like a redux of 2022. That would mean lower highs and lower lows for the duration of the year until Fed and other central banking policy must become supportive again.

Funny, because it’s been supportive for two years, and no one seems to have noticed.

Terrible work, Janet Yellen… You can see that in the aftermath of 2024, we saw drastic increases in risk, credit, and leverage. That happens when the Treasury Department issues the bulk of debt in T-bills. Those T-bills are rocket fuel for the Repo Market, and more credit and capital flow from there to the equity market.

I hate this environment because it will make insider buying more difficult. That is why I want to focus on a few things.

Defensives: I want to own stocks on the market's defensive side. Consumer staples are prime buys and holds, especially if they have good, safe dividends.

Income: If there are MLPs, good REITs, and closed-end funds with ample exposure to long-term, high-grade bonds.

I will simply say that bond duration will probably be your friend in the next few months. Not terribly long, but strong corporate bonds are going to be favorable as we move into this end of the cycle.

While we wait, here's what's catching our attention this week:

There was significant cluster buying at TriMas Corp (TRS), with six insiders—including the CEO and CFO—buying shares last week. When the top brass moves together, it's often because they collectively see something positive on the horizon, whether it's a new product, better margins, or another catalyst that's not yet public.

Interestingly, there's a pattern here—these executives have repeatedly timed their share purchases right after dividend payouts over the past year, indicating a deliberate strategy of accumulating stock when prices dip post-dividend.

Hedge fund manager Boaz Weinstein is buying into MainStay CBRE Global Infrastructure Megatrends Fund (MEGI), along with the fund’s portfolio manager.

MEGI focuses heavily on global infrastructure and energy transition investments. The fund holds familiar names like Enterprise Products (EPD), Plains All-American (PAGP), Dominion Energy (D), and Vistra (VST), covering all aspects of energy infrastructure from transportation and storage to power generation and distribution.

MEGI is trading at a 11% discount to its assets and pays an 11% distribution. This is the type of name we’ll be adding when things turn back positive.

We also have a director buying $9.6 million worth of Permian Resources (PR) stock at $12.83 per share. If you recall, PR was one of our West Texas buyout stocks from 2023. This buy indicates that value investors are once again seeing attractive entry points in the Permian basin of West Texas.

Lastly, there were several purchases at Venture Global (VG), including buys from the company's founders and Chairmen of the Board, plus a company director

Venture Global is a liquefied natural gas company that went public in January. They specialize in LNG production and exports, a sector that could thrive under Trump's renewed focus on energy independence. These insiders have been buying around the $10 mark.

While we don't have a specific trade at the moment, we’re eying something back around recent support levels at $9.25. If we decide to add this, I’ll send a note around.

Portfolio-wise, Occidental Petroleum (OXY) remains under pressure around $46.50. We plan to roll the position next week to reduce our cost basis further. I'll keep you updated on the next steps.

In our long-term portfolio, Enterprise Products Partners (EPD) just keeps performing, once again proving why we say ‘There’s always money in the midstream’.

EPD consistently generates stable cash flow by transporting energy products, proving its reliability even amid market volatility.

For now, stay patient. Opportunities are on the horizon, but we must wait for a clearer green signal before stepping on the gas.

I want you to raise the stop on STEW to $15.50. You’d keep the shares you generated through dividend investment. Nothing is safe right now.

Until then…

Stay positive,

Garrett Baldwin

GB, I started calling late cycle in 03/2024 and am now calling "end of cycle."

Critique and thoughts would be valuable to me. Diablo in Texas

great to see you theo. as you know, those folks really have their shit together.